Understanding Singapore’s Personal Income Tax: A Complete Guide for Individuals

Are you feeling overwhelmed by the complexities of Singapore’s personal income tax system? You’re not alone! With intricate regulations and potential deductions, filing your taxes accurately can be challenging. But don’t worry—this comprehensive guide will help you navigate everything you need to know about personal income tax in Singapore, from the basics to available exemptions and strategies for optimizing your tax returns.

What Is Personal Income Tax in Singapore?

Personal income tax is a compulsory levy that funds essential public services like healthcare, education, and infrastructure. It applies to various forms of income, including earnings from employment and investments. Tax residents in Singapore are taxed on their worldwide income at progressive rates, while non-residents are taxed only on income sourced from Singapore.

How Much Tax Will You Pay?

The amount of personal income tax you owe depends on your earnings and applicable tax rates. Singapore uses a progressive tax system, meaning higher incomes are taxed at higher rates.

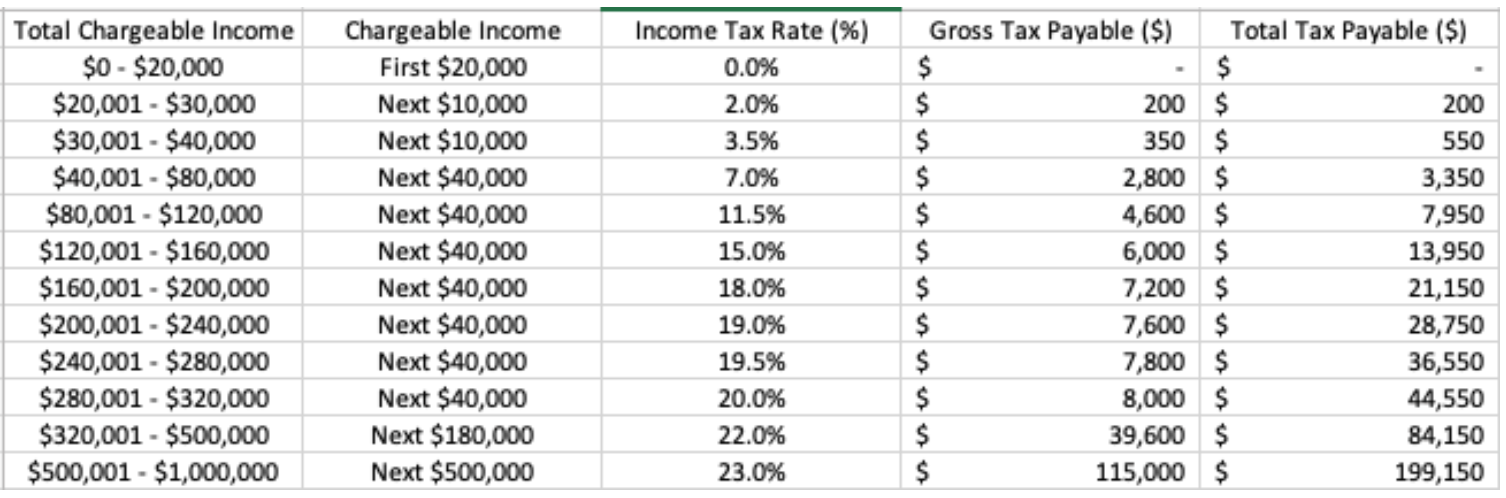

Personal Tax Rates for Residents in Singapore

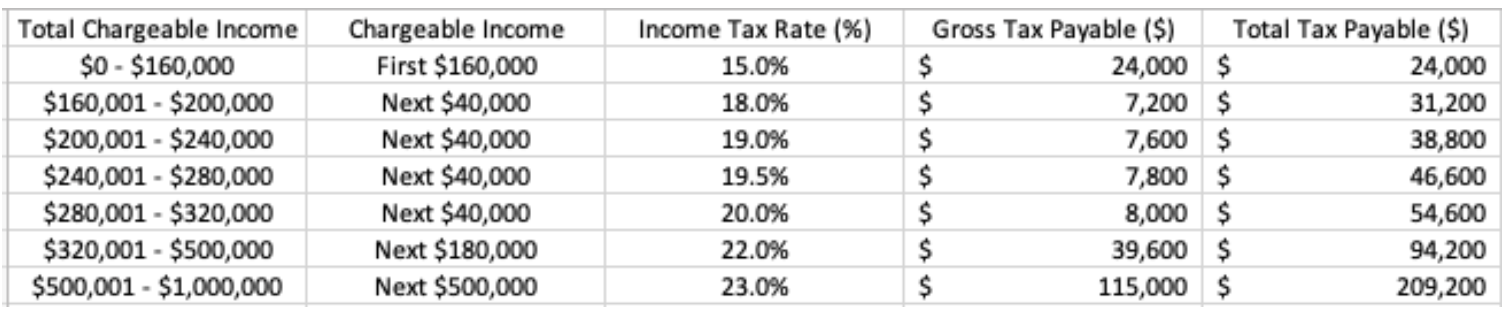

Personal Tax Rates for Non-Residents in Singapore (Employment Income only)

Taxes on director’s fee, consultation fees and all other income for non-residents is at a flat rate of 24%.

Calculating Your Income Tax

Navigating tax tables and different rates can be cumbersome. To simplify the process, we offer a Singapore income tax calculator. Download it by clicking the button below and follow the prompts to input your income and deductions for an accurate estimate of your tax liability.

Filing Your Income Tax Online

Most individuals in Singapore file their income tax online through the IRAS website. The process is straightforward and quick:

- Gather your documents: Collect Form IR8A and supporting receipts.

- Determine your tax residency: Verify your status based on your days in Singapore.

- Choose your filing method: Opt for e-Filing via myTax Portal or paper filing with Form B1.

- Access myTax Portal: Log in with your SingPass or create an account.

- Complete your tax return: Accurately fill in details about your income, deductions, and reliefs.

- Review your return: Double-check for accuracy.

- Submit your return: File electronically or mail the physical form.

- Await your Notice of Assessment (NOA): After submission, you’ll receive an NOA detailing your tax assessment.

- Pay any tax owed: If applicable, make payment by the specified due date.

Filing Your Income Tax Online

To reduce your tax burden, consider these strategies:

- Utilize tax reliefs and deductions: Identify available reliefs, such as Earned Income Relief and Parent Relief, to lower your taxable income.

- Explore tax-exempt investments: Contribute to schemes like the Supplementary Retirement Scheme (SRS) for potential tax relief.

- Optimize your tax residency: Plan your residency status strategically for better tax rates.

- Leverage tax treaties: Check for tax treaties with other countries to avoid double taxation.

- Time your income and expenses: Manage the timing of income and expenses to optimize your tax position.

- Maximize CPF contributions: Increase your CPF contributions to reduce taxable income while saving for retirement.

- Seek professional advice: Consult tax experts for personalized guidance and strategies.

Filing Your Income Tax Online

Avoid these pitfalls that can lead to penalties or overpayment:

- Overlooking eligible reliefs: Many miss out on tax reliefs they qualify for.

- Neglecting to include deductible expenses: Keep records of claimable expenses like medical costs and donations.

- Failing to update your IRAS records: Update any changes to your address or contact information promptly.

- Late filing: Submit your returns on time to avoid penalties.

For more detailed information on personal income tax in Singapore, visit the official IRAS website.

Need Assistance with Your Personal Income Tax?

You are responsible for ensuring your taxes are paid accurately and on time. Understanding personal income tax regulations is crucial for compliance.

If you need help with tax filing or have specific questions, our Lett experts are here to assist you with tailored advice.